income tax rates 2022 australia

ATO Tax Rates 2021-2022 Year Non-Residents Non-resident Tax scale 2021-22. All companies are subject to a federal tax rate of 30 on their taxable income except for small or medium business companies which are subject to a reduced tax rate of.

Home Twitter In 2022 Proposal 1 800 Word Search Puzzle

Make sure you click the apply filter or search button after entering your.

. Important information July 2022 updates. 5092 plus 325c for each 1 over 45000. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2.

Australia Personal Income Tax Tables for 2022. 39000 37c for each 1 over 120000. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1.

5 rows low and middle income tax offset lmito income tax. Ad Compare Your 2022 Tax Bracket vs. Taxable income Tax on this income.

51667 plus 45 cents for each 1 over 180000. Tax tables for previous years are also available at Tax rates and codes. Tax On This Income.

Company taxThe company tax rates in Australia from 200102 to 202122. There are seven federal income tax rates in 2022. These rates and thresholds are planned.

19 cents for each 1 over 18200. Two further incentive regimes are proposed. You can find our most popular tax rates and codes listed here or refine your search options below.

2022 2023 Income Tax Rates Australia. The following tables sets out the PIT rates that currently apply to resident and non-resident individuals for the year ending 30 June 2022. The top marginal income tax rate of 37 percent will.

Your 2021 Tax Bracket To See Whats Been Adjusted. 19c for each 1 over 18200. Tax rates and codes.

From 1 July 2022Check the fuel tax credit rates from 1 July 2022 to 28 September 2022. Personal Income Tax Rate in Australia is expected to reach 4500 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Taxable Income Tax Rate.

To get an idea of what kind of total tax savings taxpayers on a range of different incomes could make in 202223 compared to 201819 the Australian Government has. 325c for each 1. There are no changes to most withholding schedules and tax tables for the.

2022 Income Tax Rates Australia. Discover Helpful Information And Resources On Taxes From AARP. 2022 2023 Income Tax Rates Australia.

Tax on this income. 6 rows Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax.

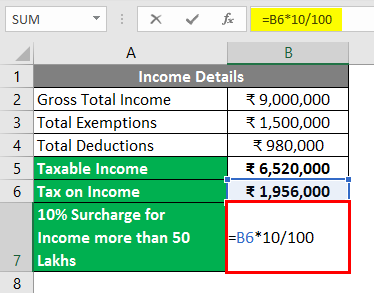

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Include Income Taxpayers In The Proposed Ups Civil Society Demands In 2022 Bank Financial Income Tax Return Financial Institutions

Income Tax Assessment Act 1936 Australia 2018 Edition Paperback In 2022 Book Club Books Independent Publishing Acting

What Are Marriage Penalties And Bonuses Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Excel Formula Income Tax Bracket Calculation Exceljet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Income Income Tax Return Paying Taxes

Leading Accounting Outsourcing Firms In India Meru Accounting In 2022 Accounting Services Bookkeeping Services Bookkeeping

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)